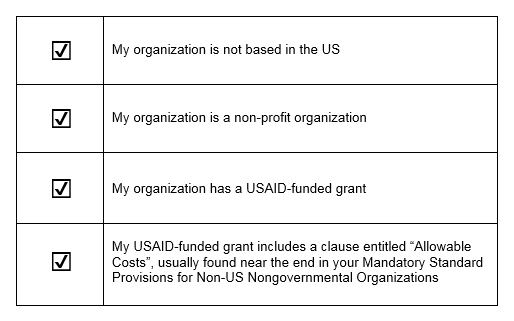

If you’re a local NGO and you’ve just received (or are currently implementing) a USAID grant, congratulations! This blog space is for you. Here, we’ll attempt to explain some of the requirements that are fairly standard in agreements. But first, let’s make sure that we understand what agreements we’re discussing in this blog. This blog will be helpful and applicable if your organization meets all these criteria:

Please note, if you don’t meet these criteria, but are implementing a USAID project, LINC can still help! We advise local and international NGOs worldwide on best practices in USAID project management, finance, compliance, and contracts. Get in touch and let’s see how we can collaborate.

Now, let’s get to the fun stuff. Let’s talk about one of the most important Mandatory Standard References for cost-reimbursable grants: Allowable Cost. The Allowable Cost clause tells us a few very important things: 1) what we can use our grant money for, and 2) what we cannot use our grant money for. This blog won’t address all the requirements in this clause, but we’ll try to define some helpful boundaries. First, what does “allowable” even mean? This is a complicated concept; I like to present it like this – for a cost to be allowable, it MUST:

1. Be reasonable – this means the cost would be generally recognized as ordinary and necessary for the grant goals, and it is a cost that would be incurred by a prudent person in the conduct of normal business. My test – would I personally buy this item or service if this were my own money and I needed to get the grant goal done? For example, would I buy a well-reviewed laptop for a year long project that is priced around $650? Probably. Would I buy a gold-plated desk-top that has to be custom made in Brussels and costs $8,907 and $200 in shipping? Probably not. Reasonable versus unreasonable.

2. Be allocable – this means the cost is incurred specifically and entirely for your grant. My test – will this item or service benefit only the goals of my grant (not other projects or organization goals? If so, it’s probably allocable.

3. Be allowable by definition – this means that the cost is not specifically prohibited by its very nature under my grant. What? That’s confusing! To be allowable it has to… be allowable. Yes! My test – take a look at a general (but not fully comprehensive) list below of unallowable costs. If your item or service is not on that list, it could be allowable.

Now, the confusing part, to be allowable, the cost must meet all the criteria above: 1) be reasonable, 2) be allocable, and 3) be allowable by definition (read – not ‘unallowable’ or prohibited by your grant agreement).

Common Unallowable Costs

- Public relations and advertising costs are unallowable

- Bad debts are unallowable

- Salaries and consultant costs are unallowable if they are not reasonable

- Contingencies are unallowable

- Contributions and donations are unallowable

- Entertainment is unallowable (differs from non-profit regs)

- Fines, penalties, and mischarged costs are unallowable

- Independent research and development costs that are deferred are unallowable

- Insurances where the contractor is the beneficiary and that are not at market price are unallowable

- Interests on borrowings are unallowable

- Lobbying and political activity costs are unallowable

- Losses on other agreements are unallowable (USG or not)

- Costs associated with M&E and with planning or executing organization or reorganization of corporate business structure, and costs associated with raising capital or change in ownership are all unallowable

- Patents are unallowable

- Costs for relocation of an employee who resigns before 12 months for reasons within his/her control are unallowable

- Taxes for financing, refinancing, or reorganizing and organization are unallowable

- Alcohol is unallowable

Need more help or have questions? Contact LINC at info@linclocal.org and get in touch. We offer direct consulting services to local and international NGOs to help you manage your USAID project and maximize impact.